Health Insurance Claim Settlement Ratio

When it comes to choosing a health insurance policy, one of the most important parameters to consider is the company’s claim settlement ratio. A high claim settlement ratio means that the insurer will honour more claims than it denies, which is good news for consumers. But sometimes insurers don’t agree to settle claims and policyholders face difficulty claiming the amount they are entitled to. To make this process more convenient, you should look for a high claim settlement ratio from the insurance company.

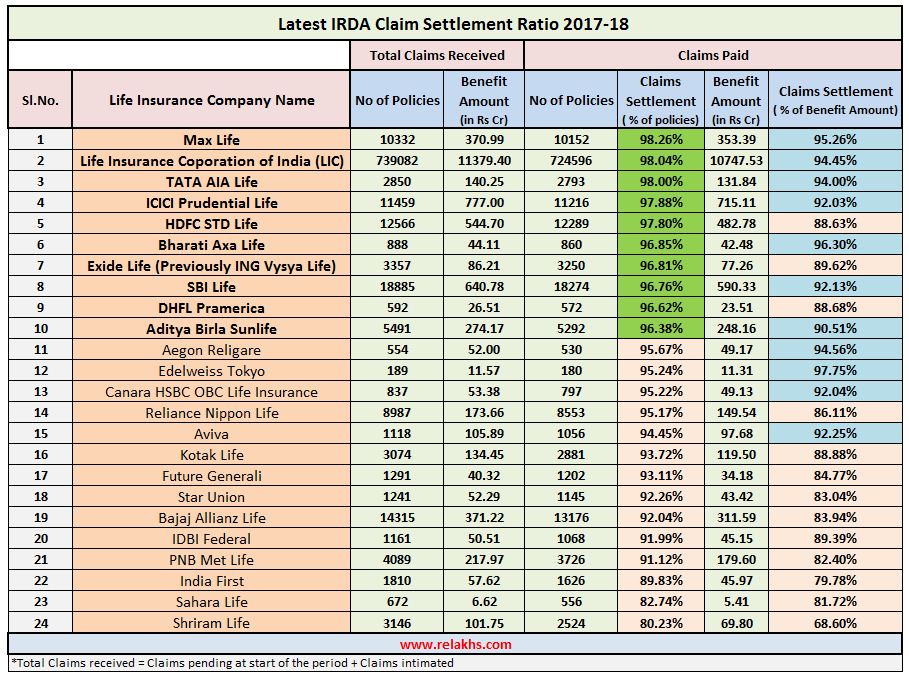

The claim settlement ratio is an important metric to determine how reliable a health insurance company is. It measures the number of claims settled in a year against the number of claims received. It is calculated for each financial year and is an indication of the insurer’s reliability. When choosing an insurer, make sure to check the most recent claim settlement ratio from each company.

Bajaj Health Insurance Plan for Families – Health Guard is a family plan that includes pre-hospitalisation and post-hospitalisation expenses. It covers the proposer and dependent children until they are 30 years of age. The policy also covers pre-hospitalisation expenses for up to 30 days before the date of admission, and expenses for up to 90 days after discharge.

Bajaj Insurance also offers free health checkups every three years. You can also avail the Health Claim by Direct Click feature of the Insurance Wallet App. This will save you both time and money. However, you should be aware that bajaj finserv health insurance does not cover diseases contracted before 30 days from the policy’s issuance. It also has a 30-day waiting period for pre-existing diseases.

Bajaj Health Insurance Claim Settlement Ratio

Bajaj Health Insurance Claim Settlement Ratio is an important factor to consider when purchasing a policy. It reflects the insurer’s ability to settle a claim compared to the number of claims it receives. It also reflects a company’s reputation for handling claims. A high CSR indicates a health insurance provider that is good at dealing with claims.

When considering health insurance, consider the claims settlement ratio of each company. It’s a good indicator to help you choose the right insurance company. The ratio is calculated by the Insurance Regulatory and Development Authority of India, the apex regulator of the insurance industry in India. It measures how often a particular insurance company has paid out claims compared to the premiums it has collected.

If you have an emergency, you can opt for a cashless hospitalisation option through your health insurance company. To do this, simply show your health insurance card to a hospital help desk and present it to them. They will verify your details and submit a pre-authorisation form. Once verified, your insurer will send you a letter approving the cashless treatment you are seeking.

Similarly, you can also check out the company’s claim settlement ratio through the IRDAI’s annual report. Check the latest numbers before purchasing health insurance. While the claim settlement ratio is an important indicator, you should also consider the policy’s benefits, premium, and the policy term.

With the Bajaj Health App, you can search for a doctor in your area or by symptoms. Once you find the right doctor, you can choose a clinic, set the appointment type, and confirm your appointment. The app also allows you to chat with a doctor online in a variety of languages.