Digital Asset Custody Provider

In a rapidly evolving market, the role of a digital asset custody provider is critical to the development of the digital asset industry. These firms are critical for attracting and retaining a diverse investor group. The growing interest in digital assets has prompted a growth in the variety of custody options available, and new providers are constantly seeking to develop the controls and structures that best fit their market.

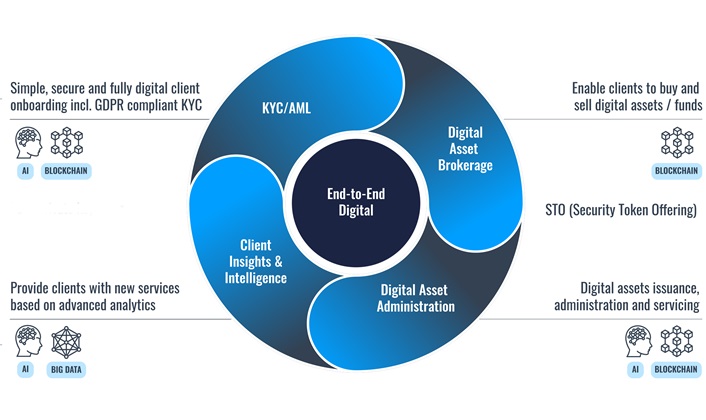

One possible solution for the industry is the creation of a digital asset sub-custodial relationship. This will allow institutions to provide their clients with secure, integrated access to the digital asset market without having to develop the infrastructure from scratch. This option is increasingly popular with institutions that are looking for a low-risk, integrated approach to digital asset custody.

Digital asset custody requires specialized expertise in the field. Fintechs and crypto-asset specialists have dominated the market, but larger financial institutions are likely to enter the space, too. Fidelity recently announced that it will launch a crypto-custody service in March 2019. A number of challenges remain, including the need to ensure the privacy of private keys and transaction addresses. Also, digital assets must be classified as securities, which can add additional complexity to the process.

As a result, third-party digital asset custody solutions are a great choice for institutional investors. They offer a variety of different services that are designed to help them keep their clients’ crypto. Some custodians provide their own technology, while others use a third-party provider. The difference between these three options is primarily related to the security, compliance, and technological solution they offer.

The Role of a Digital Asset Custody Provider

Some custodians have an extensive range of services, including cold storage. In addition to cold storage, many exchanges offer a range of options for digital asset custody. Coinbase also offers a specialized digital asset custody service through Coinbase Custody, which is an SEC-approved subsidiary.

A third-party custody service provides a high level of security for digital assets. These services are suitable for institutions, retail investors, and high-net-worth individuals. They offer different levels of security, with hot wallets being online and accessed via the internet, and cold wallets being offline and lacking remote control. While both options offer high levels of security, they can also take longer to transact.

A digital asset custodian must offer robust services, including secure storage, access control, and buying and selling. The service must provide security and privacy as well as a safe way to manage private and public cryptographic keys. Cryptographic keys are the key to digital asset custody. By using cryptography, the keys are secured and can’t be intercepted by third parties.

To protect the digital assets from cybercriminals, family offices should select a digital asset custodian that meets their needs. Some family offices need customisation, while others may need more sophisticated solutions. For example, a family office may need a fully licensed, insured digital asset custody service.