Carbon Credit Money

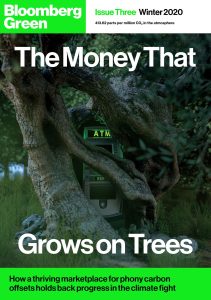

A carbon credit is a financial tool used to offset emissions. When someone buys one, they give money to those who reduce, avoid, or destroy carbon from the atmosphere, such as a farmer who plants trees, a corporation that invests in wind turbines, or an energy company that captures pollution at a power plant. The idea is that reducing emissions helps slow climate change, and the world benefits from everyone taking part.

Almost anyone can participate in the voluntary carbon.credit market, from individuals planning their weddings to large corporations looking to offset the full scope of their emissions. While the overall market operates largely unchecked by regulators, there are a number of respected standards organizations that validate carbon credits.

The prevailing standard is called the Verified Carbon Standard. It consists of accounting methodologies specific to each type of project, independent auditing and a registry system. The intention is to ensure that the resulting carbon credits are high quality, and that buyers can have confidence they are buying something valid.

Where Does Carbon Credit Money Go?

As a result of the proliferation of these standards, there are now nearly 20 exchanges where investors can purchase and trade carbon credits. But despite the popularity of carbon markets, they aren’t without problems. High-quality credits are scarce, and it can take a long time to verify a new carbon reduction project. This is particularly true for community-based projects, which have a lower production volume and require more detailed and costly accounting and verification processes than industrial or other types of projects.

Several factors are driving these problems. Demand for carbon credits is growing, and the price is increasing rapidly. However, clear demand signals aren’t yet in place to drive the development of liquid markets with scaled-up supply. The market is also burdened by insufficient liquidity, poor financing and risk-management services, and limited data availability.

Governments that regulate their companies’ emissions use a market-based system known as cap and trade. This involves limiting the total amount of emissions allowed by a state or country, then offering businesses the opportunity to offset their emissions with carbon credits.

Companies that want to limit their emissions may buy and sell the credits on a secondary market that is overseen by the regulatory body. Those who are unable to limit their emissions within the cap must pay a fine or face penalties.

Some governments have created their own carbon trading systems, such as California’s. Its cap and trade system is the largest in the world. Companies that have a permit to emit greenhouse gases must reduce their overall emissions by an annual percentage below business-as-usual levels. They can do this by purchasing carbon credits from those who are able to reduce their emissions below the cap.

The resulting market is driven by the need to comply with the state’s emission caps and by investor interest in carbon assets. But it can also help fund sustainable development and reduce poverty in developing countries. This is because many of the projects that produce credits through the reforestation, soil carbon enrichment, and methane gas capture processes also deliver additional social, environmental and economic benefits that are not included in the underlying project’s certified GHG reduction potential.